Just a few days ago, a startling finding emerged tying most of the mortgage meltdown to Fannie, Freddie, the VA and HUD.

Now a comprehensive picture of how well-meaning but fatally flawed Federal Government policies created the crisis. (Emphasis mine.)

Rewind to 1994. That year, the federal government declared war on an enemy — the racist lender — who officials claimed was to blame for differences in homeownership rate, and launched what would prove the costliest social crusade in U.S. history. At President Clinton's direction, no fewer than 10 federal agencies issued a chilling ultimatum to banks and mortgage lenders to ease credit for lower-income minorities or face investigations for lending discrimination and suffer the related adverse publicity. They also were threatened with denial of access to the all-important secondary mortgage market and stiff fines, along with other penalties.

The threat was codified in a 20-page "Policy Statement on Discrimination in Lending" and entered into the Federal Register on April 15, 1994, by the Interagency Task Force on Fair Lending. Clinton set up the little-known body to coordinate an unprecedented crackdown on alleged bank redlining.

The edict — completely overlooked by the Financial Crisis Inquiry Commission and the mainstream media — was signed by then-HUD Secretary Henry Cisneros, Attorney General Janet Reno, Comptroller of the Currency Eugene Ludwig and Federal Reserve Chairman Alan Greenspan, along with the heads of six other financial regulatory agencies. "The agencies will not tolerate lending discrimination in any form," the document warned financial institutions.

Ludwig at the time stated the ruling would be used by the agencies as a fair-lending enforcement "tool," and would apply to "all lenders" — including banks and thrifts, credit unions, mortgage brokers and finance companies.

Practically the entire administration was duped by a flawed study:

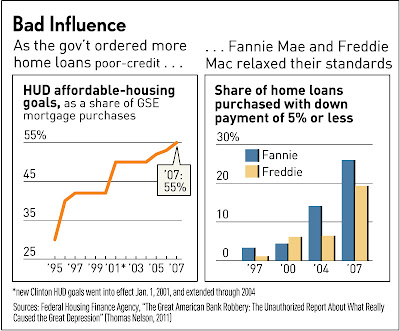

The unusual full-court press was predicated on a Boston Fed study showing mortgage lenders rejecting blacks and Hispanics in greater proportion than whites. The author of the 1992 study, hired by the Clinton White House, claimed it was racial "discrimination." But it was simply good underwriting.They not only created a false demand for low-quality loans, they cranked up the target over time, in a 'well meaning but fatally flawed' attempt to combat non-existing discrimination. See graphic.

It took private analysts, as well as at least one FDIC economist, little time to determine the Boston Fed study was terminally flawed. In addition to finding embarrassing mistakes in the data, they concluded that more relevant measures of a borrower's credit history — such as past delinquencies and whether the borrower met lenders credit standards — explained the gap in lending between whites and blacks, who on average had poorer credit and higher defaults.

The study did not take into account a host of other relevant data factoring into denials, including applicants' net worth, debt burden and employment record. Other variables, such as the size of down payments and the amount of the loans sought to the value of the property being bought, also were left out of the analysis. It also failed to consider whether the borrower submitted information that could not be verified, the presence of a cosigner and even the loan amount. When these missing data were factored in, it became clear that the rejection rates were based on legitimate business decisions, not racism.

Still, the study was used to support a wholesale abandonment of traditional underwriting standards — the root cause of the mortgage crisis.

For the first time, Washington's bank regulators put racial lending at the top of their checklist. Banks that failed to throw open their lending windows to credit-poor minorities were denied expansion plans by the Fed in an era of frenzied financial mergers and acquisitions. HUD threatened to deny them access to Fannie Mae and Freddie Mac, which it controlled. And the Justice Department sued them for lending discrimination and branded them as racists in the press.

"HUD is authorized to direct Fannie Mae and Freddie Mac to undertake various remedial actions, including suspension, probation, reprimand or settlement, against lenders found to have engaged in discriminatory lending practices," the official policy statement warned.

Now, President

Its the Federal Government that makes up the 'irresponsible' part.

5 comments:

Excellent article.

"The author of the 1992 study, hired by the Clinton White House, claimed it was racial 'discrimination.' "

...

"It took private analysts, as well as at least one FDIC economist, little time to determine the Boston Fed study was terminally flawed."

These two statements jumped out at me...

Do we know who the author was? Any indication that the omission was a deliberate one?

In other words - was this deliberate? (meaning here that the intent was to expand the loans to minorities, not necessarily to cause the massive meltdown. Although...??)

Suek I went over to IBD to look at the comments to see if anyone asked those questions. It doesn't look like they did, but does look like Bobn is there masquerading as MortgageGuy, kind of funny the debate they are having.

http://news.investors.com/Article.aspx?id=589858&p=3

Anyways, to your point about the intent, yes I do believe the intent was to get more money into the hands of those who could least afford it. Done in the 'name' of fairness. The law of unintended consequences rears its ugly head and ... *poof* Mortgage Meltdown.

The tipping principle applies, which says it takes a small amount of intervention to make a big movement in the unstable market, especially when margins were so thin (they were making loads at %120 of value back then.)

Bob

*loans

I think this now-classic assemblage of the Dem committee members denying in 2004 that there was any problem, even as they were warned by regulators... Wait for the money quote towards the end where Barney Frank wants to "keep rolling the dice", IIRC.

Cram downs to the rescue!

Post a Comment